БҮТЭЭГДЭХҮҮН ҮЙЛЧИЛГЭЭ

Амар зээл

Амар зээл

Автомашин болон үл хөдлөх хөрөнгө, дугаар барьцаалсан орлого нотлохгүй бүх төрлийн хэрэглээний зээл.

Автомашины зээл

Автомашины зээл

Шинэ болон дугаартай автомашин худалдан авах зориулалтын зээл

Хэрэглээний зээл

Хэрэглээний зээл

Өрхийн хэрэглээ болон сургалтын төлбөр, эмчилгээг санхүүжүүлэх хэрэглээний зээл.

Дижитал зээл

Дижитал зээл

"Netapp" аппликейшнийг app store болон play store-с татан авч өөрийн мэдээллээ бүртгүүлэн баталгаажуулснаар манай аппликейшнийг ашиглах боломжтой.

ЗЭЭЛИЙН ХҮСЭЛТ ИЛГЭЭХ

Эрхэм харилцагч та дараах холбоосоор орж зээлийн хүсэлт илгээх боломжтой. Манай эдийн засагчид таны хүсэлтийн дагуу дариу хариу өгөх болно.

Компанийн тухай

Нэткапитал санхүүгийн энтерпрайз нь 2008 онд байгуулагдсан цагаасаа эхлэн харилцагч, үйлчлүүлэгчдийнхээ хэрэгцээг хангах үйлчилгээг нэвтрүүлэн, түүнийгээ улам төгөлдөржүүлж, санхүүгийн бүтээгдэхүүний үлгэр жишээ загварыг бий болгохыг зорин ажиллаж байна.Банк санхүүгийн салбарын тэргүүн эгнээнд алхаж, харилцагчаа сэтгэл хангалуун байлгах эрхэм үүргийг зорилгоо болгосон бид Монгол улсын хэмжээнд ажиллаж буй 24 салбар нэгжийн 350 гаруй мэргэшсэн ажилтнуудаараа дамжуулан, 74.000 харилцагчидаа санхүүгийн цогц үйлчилгээг хурдан шуурхай хүргэж байна.

МЭДЭЭ МЭДЭЭЛЭЛ

-

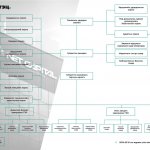

Компанийн “Үнэт зүйл, Соёл” болон “Бүтэц, зохион байгуулалт”-г шинэчлэн баталлаа

2024-04-02 -

Нэткапитал финанс корпораци ББСБ ХХК-ийн 2024 оны ТУЗ-ийн ээлжит хурал амжилттай зохион байгуулагдлаа.

2024-04-02 -

Ололт, Амжилт, Дижиталчлал "Annual Meeting - 2024" амжилттай зохион байгуулагдлаа.

2024-04-02 -

Нэткапитал санхүүгийн групп TQCSI Mongolia XXK-н 2023 оны шилдэг харилцагч байгууллага боллоо

2024-02-20 -

ISO9001:2015 ЧАНАРЫН УДИРДЛАГЫН ТОГТОЛЦООНЫ СТАНДАРТЫГ ДАХИН БАТАЛГААЖУУЛЛАА.

2023-12-13 -

Нэткапитал санхүүгийн групп: МЭДЭГДЭЛ

2023-11-13 -

Нэткапитал санхүүгийн групп нь НҮБ-ын 17 зарчмын 3 дахь эрүүл мэндийг дэмжих зарчмын хүрээнд нийгэмд чиглэсэн 2 ажлыг зохион байгууллаа.

2023-05-29 -

Бид Ирээдүйд Хөрөнгө оруулна

2023-01-31 -

Нэткапитал санхүүгийн групп Мэдээллийн Аюулгүй Байдлын Удирдлагын Тогтолцооны ISO/IEC 27001:2013 стандартыг амжилттай нэвтрүүллээ

2023-01-20 -

"Тогтвортой санхүүжилтийн бодлого"-г баталлаа

2022-12-27 -

Монгол Жангум: Хөрөнгө оруулалт гэдгийг би чин сэтгэлийн шударга хөдөлмөр гэж ойлгодог.

2022-12-09 -

"BLACKBERRY"-Н АМЖИЛТЫН ТҮҮХЭЭС

2022-09-22 -

МЭДЭЭЛЛИЙН АЮУЛГҮЙ БАЙДЛЫН БОДЛОГО

2022-08-01 -

5,400,000,000 ₮ АМЖИЛТТАЙ ТАТАН ТӨВЛӨРҮҮЛЛЭЭ

2022-07-25 -

Компанийн засаглалын кодекс шинэчлэгдсэнтэй холбогдуулан ТУЗ-ийн ээлжит хурал болж өндөрлөлөө.

2022-06-30

.png) (+976) 7500-6666

(+976) 7500-6666.png) Салбарууд

Салбарууд.png) Зээлийн хүсэлт

Зээлийн хүсэлт